We are several weeks into a crisis of unimaginable proportions which has turned the world upside down. The aviation industry is no stranger to crises, but while the industry’s ability to bounce back is testament to the crucial role aviation plays in the global economy, each crisis has changed the shape of the aviation, globally.

This survey focuses on the impact of COVID-19 on commercial aviation in Nigeria. Prior to the crisis, aviation contributed $1.7 billion to Nigeria’s GDP and supported 241,000 jobs. IATA estimates that the COVID-19 crisis puts 124,000 Nigerian jobs at risk and some $900 million of the country’s GDP. As the crisis continues, the impact deepens and jeopardises many businesses, individuals, and families.

We are in unchartered territory and this requires creative and innovative solutions to the challenges ahead. This is a time for aviation industry stakeholders to act proactively – and in sync – to avoid unilateral decisions in response to COVID-19.

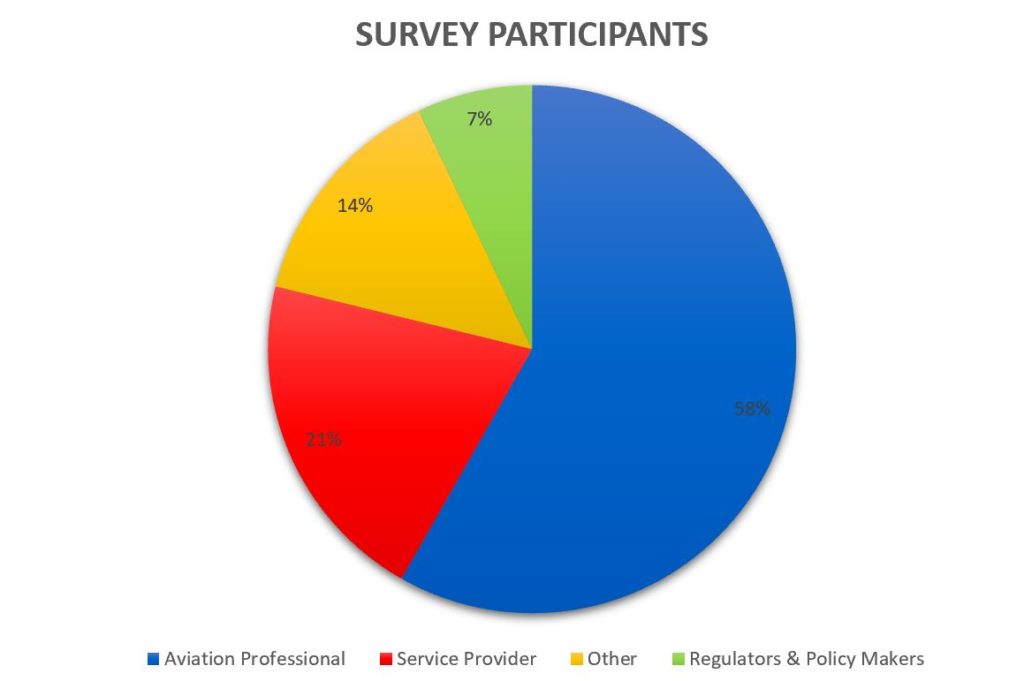

With this in mind Avaero Capital Partners surveyed 170 Nigeria aviation professionals to understand their views on the impact of COVID-19 on business, the timing of recovery and how this crisis is likely to affect passenger behaviour, industry practices and possible government intervention.

Executive Summary

This industry survey was completed in early May 2020. It captured the views of 170 aviation professionals and service providers who operate across the commercial aviation value chain in Nigeria.

The COVID-19 pandemic has introduced new practices such as social distancing and raised hygiene awareness, which in turn changed passenger behaviour on international and domestic routes, even before the government closed Nigerian airports to both domestic and international travellers. The effects of passenger behaviour post-COVID-19 are as yet unknown, but it is clear passengers will need persuading to return to the air once domestic and international airspace is reopened – whenever that may be.

Hard decisions need to be taken by the industry and the government. Actions need to be proactive and sensitive to passenger concerns. The obvious solutions such as social distancing on aircraft, to mitigate risks and encourage a return to the skies, may not be sustainable or an option when you take into account aviation economics. But doing nothing is not an option.

Any response needs to be in sync with all stakeholders, including customers, airlines, service providers, regulators and governments. The industry is optimistic of recovery, but Nigerian aviation does not operate in a vacuum, so what is needed is a global coordinated response to encourage and enable travel. Communication and increased awareness of mitigation activities must be part of the response of the Nigerian aviation industry. It is clear the industry must avoid unilateral decisions and unite to create passenger confidence and enable a sustainable business recovery to pre-COVID-19 levels and better, as soon as financially viable.

Key findings:

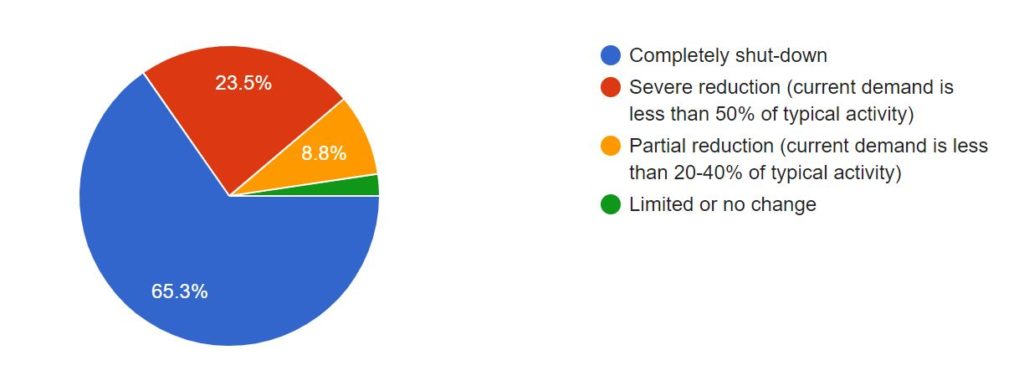

The Nigerian aviation industry is in crisis and immediate intervention is needed by all to prevent the obliteration of the domestic and regional aviation markets. The crisis has resulted in a total or partial shutdown of aviation businesses.

- 65% of respondents had completely shut their businesses as a result of COVID-19.

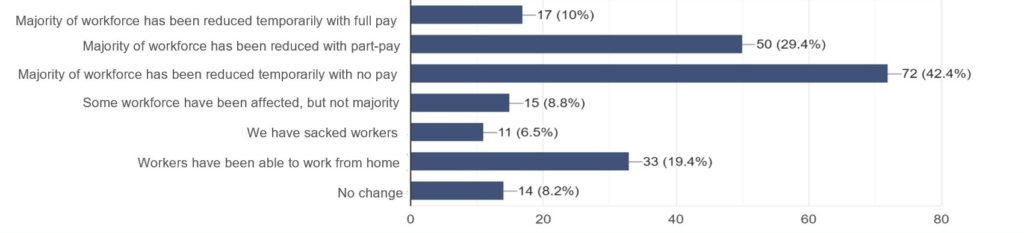

- 42% of the workforce reduced temporarily with no pay.

COVID-19 Business Impact

Unsurprisingly, an overwhelming majority of respondents indicated that business activity has severely contracted as a result of the pandemic. The COVID-19 crisis has resulted in a total or partial shutdown of aviation businesses in Nigeria.

- 65% of respondents had completely shut their businesses as a result of the pandemic.

- With over 40% of the workforce reduced temporarily without pay.

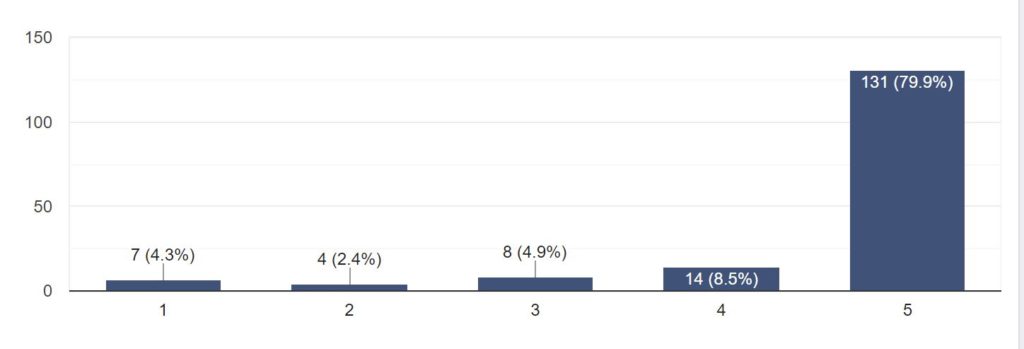

- 80% very concerned about paying salaries we have already seen several airlines reduce or suspend salary payments for March and April, May and June salary payments are equally in doubt.

- 62% were very concerned about covering calendar items with no operations. 47% were very concerned about aircraft lease payments, whilst 45% were very concerned about aircraft maintenance – running costs. 43% were concerned about aircraft storage and maintenance. 40% stated they were very concerned about the cost of aviation fuel.

COVID-19 Lockdown expectations and recovery timing

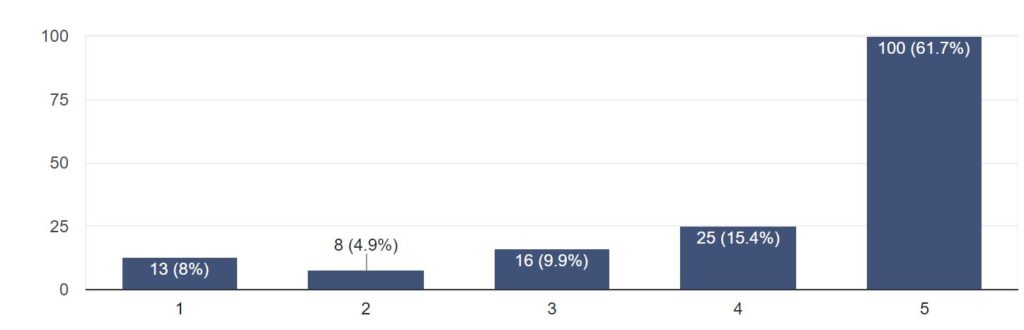

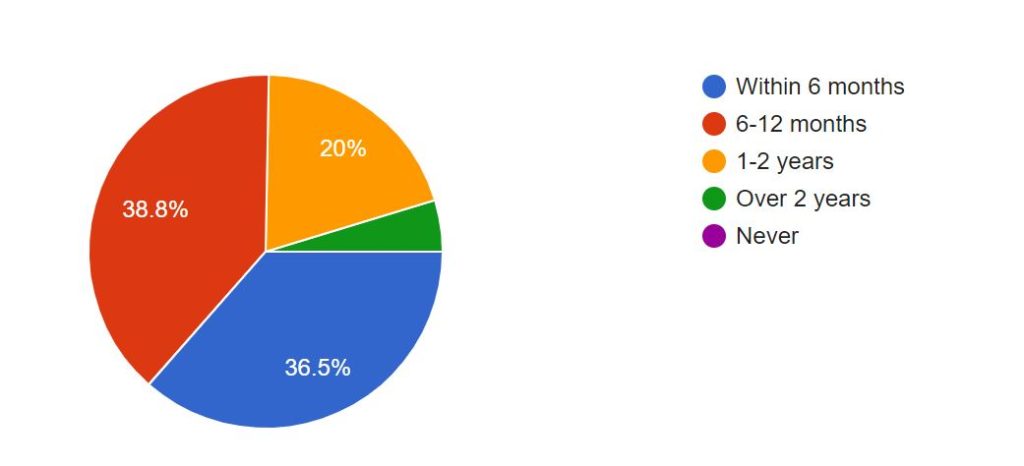

Despite the devastating impact on the Nigerian aviation sector, 75% of respondents were confident of recovery within 12 months, with 38% expecting a return to pre-COVID-19 levels of business activity within 6 to 12 months. Whilst 37% of optimists were expecting recovery to be back to pre-COVID-19 business activity levels within 6 months.

- 44% of respondents expected flight activity to be stopped by 1-2 months, whilst 36% were less optimistic and were anticipating flights to be stopped for 3-6 months.

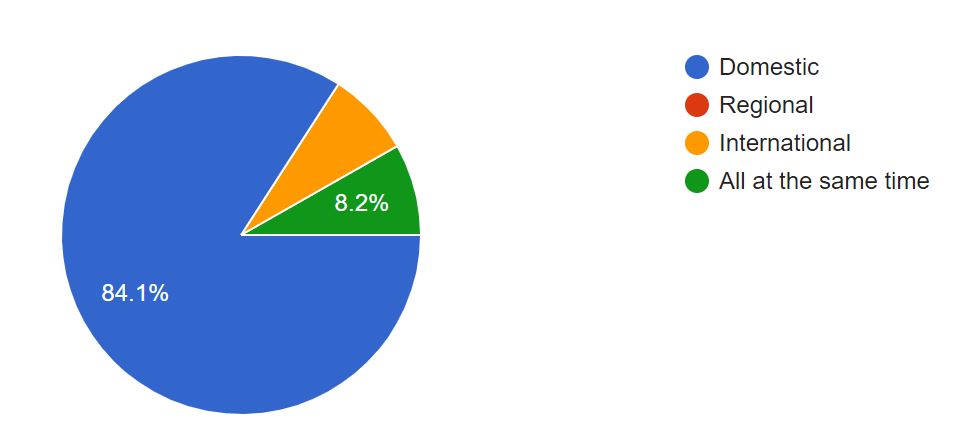

- 84% of respondents were confident domestic travel would be the first airline segment to recover.

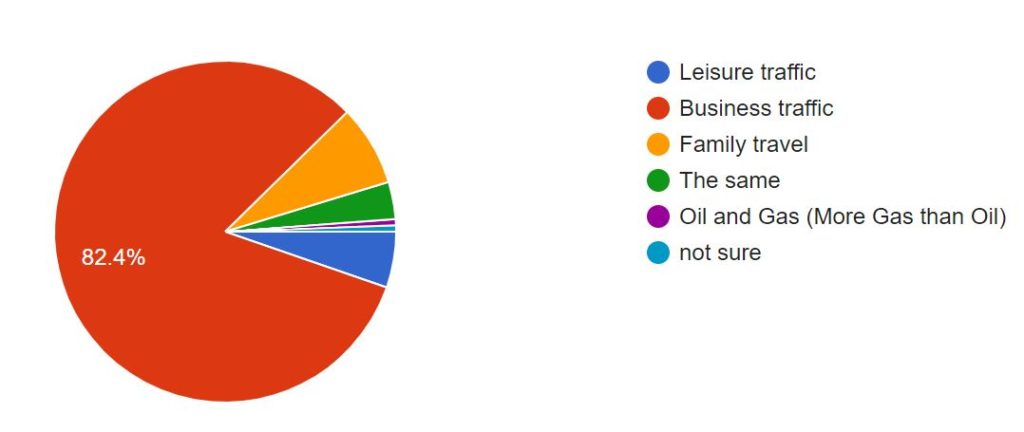

- 82% of respondents expecting business travel to recover first.

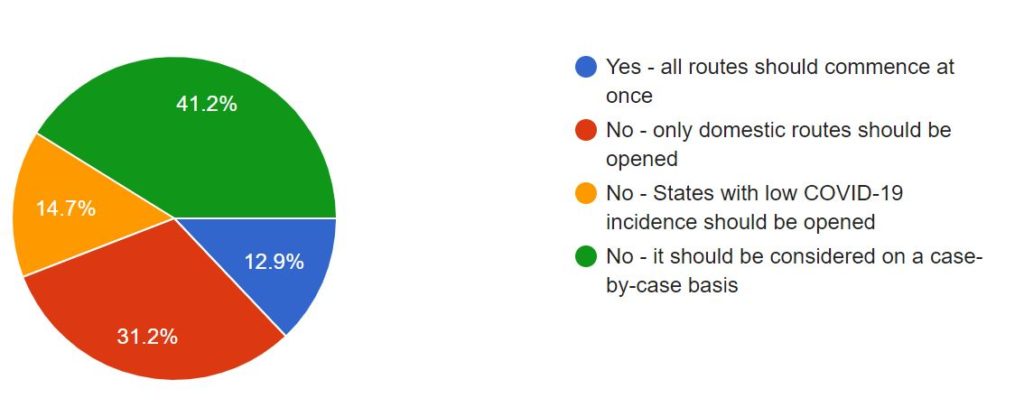

- 41% believed that route openings should be considered on a case by case basis.

COVID-19 Impact on passenger behaviour

There is a global expectation that passenger behaviour will change in the aftermath of the pandemic. Based on the increase in web conferencing software and enforced working from home, which may well become the norm for many businesses, we asked about anticipated consumer behavioural changes and how this would impact the aviation industry.

- 69% agreed that there will be reduced demand for conferences and other events that attract large crowds.

- 65% of respondents agreed that passengers would take less indirect international flights and would prefer to fly non-stop to destinations.

- 63% of respondents agreed that there would be an increase in demand for private aviation among corporate and HNW individuals.

COVID-19 Impact on industry practices

It is clear inaction is not an option at this time. Therefore, in order to mitigate passenger travel concerns to encourage a return to the skies, we asked about the immediate actions the airline industry could take to improve passenger confidence. We have summarised the results below:

- 95% agreed increase in passenger awareness of sanitary and health conditions in destination state or country would improve passenger confidence.

- 94% agreed that an increase in passenger awareness of sanitary and health conditions on aircraft would improve passenger awareness.

- 90% agreed that a temperature check at airport before check-in would improve passenger confidence.

- 90% agreed that enhanced cabin disinfection between flights from accredited cleaning firm would improve passenger confidences.

- 89% agreed that a temperature check before boarding would improve passenger confidence.

- 89% agreed the compulsory introduction of sanitary controls e.g. wearing masks and gloves at airports would increase passenger confidence.

- 85% agreed the compulsory introduction of sanitary controls, e.g. wearing masks and gloves on aircraft would increase passenger confidence.

- 80% agreed enhanced cabin disinfection between flights by cabin crew would improve passenger behaviour.

- 74% agreed compulsory testing of all passengers and crew prior to flight would improve passenger confidence.

- 67% agreed that the introduction of health verification e.g. antibody or vaccine certification prior to travel would improve passenger confidence.

COVID-19 Immediate airline response

With high levels of capital investment, retained personnel, fixed and pre-determined costs, lack of revenue will be having a catastrophic impact on airlines finances. We asked about the immediate steps which should be considered by airlines to save the industry from the looming effects of the pandemic. We summarise the results below:

- 78% agreed airlines should renegotiate costs with suppliers.

- 62% agreed airlines should stop catering services on domestic flights below on hour.

- 60% agreed that airlines should reduce seats to enable social distancing by leaving the middle seat vacant.

- 59% agreed airlines should reduce schedule after lockdown.

- 52% agreed airlines should reduce cabin crew (to minimum required by ICAO / NCAA).

- 51% agreed airlines should reduce routes after lockdown.

- 49% agreed airlines should enter into mergers & partnerships with other airlines.

- 44% agreed airlines should reduce ticket prices.

- 40% agreed airlines should cancel aircraft orders.

- 40% agreed airlines should convert passenger aircraft into cargo operations to optimize opportunities available for. freight of medical supplies, agricultural cargo and make necessary regulatory changes.

COVID-19 Response by FAAN

Airlines alone cannot bring back passengers, airports also have a part to play. A united approach by airlines and airports is needed to provide clarity and consistency to passengers.

We asked respondents what FAAN should do to bring back consumer confidence.

- 92% agreed FAAN should maintain social distancing throughout airport. 72% strongly agreed.

- 95% agreed temperature check at airport would improve passenger confidence. 79% strongly agreed.

- 76% agreed full body sanitizing of all passengers and crew before entering airport would improve passenger confidence. 58% strongly agreed.

- 61% agreed removal of plastic trays at security would improve passenger confidence. 44% strongly agreed.

COVID-19 Government immediate response needed

The aviation industry in Nigeria faces unprecedented challenges which it cannot resolve by itself. There have been several calls for government support or financial intervention. We asked respondents what changes they want from the Federal Government to support the aviation sector at this time. There was an overwhelming expectation that the Government should provide support to the industry in recognition of the economic impact of the pandemic and the critical nature of the aviation industry to Nigerian in terms of connectivity, job creation, and contribution to GDP. We have summarised the results below:

- 85% agreed the FG should provide rebates on payroll taxes paid to date in 2020 and/or extension of payment terms for the rest of 2020.

- 77% agreed the FG should provide subsidies on aviation fuel.

- 77% disagreed with the suggestion that the Federal Government should not provide financial assistance for the aviation sector.

- 76% agreed the FG should provide direct financial support for reduced revenues and liquidity attributable to travel restrictions imposed as a result of COVID-19.

- 76% agreed the FG should provide temporary waiver of ticket taxes and other government imposed levies.

- 75% agreed the FG should provide grants to cover unavoidable costs to compensate for reduced revenues and liquidity attributable to travel restrictions imposed as a result of COVID-19.

- 74% agreed the FG should provide loans to cover salaries and essential costs to compensate for reduced revenues and liquidity attributable to travel restrictions imposed as a result of COVID-19.

- 71% agreed the FG should implement VAT removal from pax tickets as was previously anticipated without further delay.

- 65% agreed the FG should allow employees to deduct up to 20% from pension scheme.

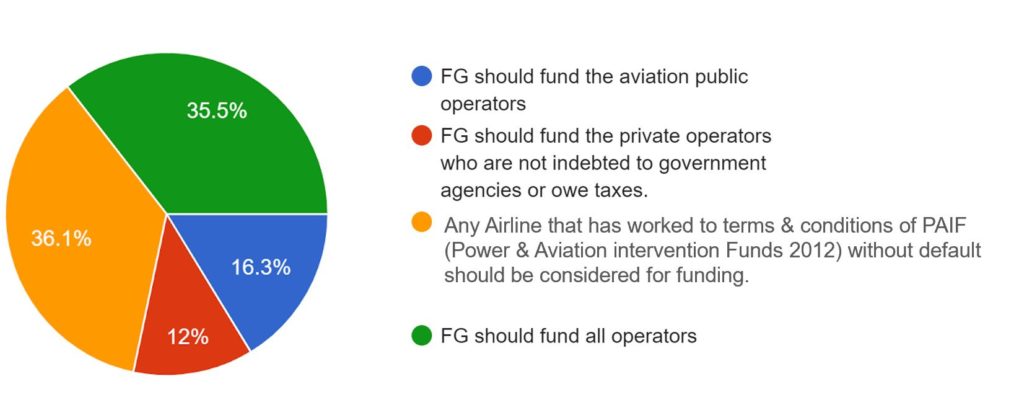

We asked respondents who agreed that the Federal Government should provide support to express what form that intervention should take, and more specifically who should benefit from the intervention. There were the responses.

We asked respondents what type of intervention they wanted to see from the Federal Government. We have summarised the results below:

- 76% agreed FG should make available a 10 year loanable fund of not more than 5% interest with a 2 year moratorium.

- 65% agreed the FG should provide a government backed guarantee to enable obtaining private sector finance.

- 65% agreed that the CBN via VP’s Committee should provide 200 to 250 billion Naira ($500-625 million) loanable fund at 3 to 4% interest for 10 years with a 1 to 2 year moratorium.

- 64% agreed any support should be on the basis of retaining the workforce, e.g. government to pay % of salaries.

- 63% agreed to support for the corporate bond market by governments or central bank.

- 56% agreed FG should recapitalise the airlines by providing collateralised / secured debt.

- 56% agreed FG should provide equity investment into airlines.

- 49% agreed that although government receives 80% of revenue from foreign airlines, benefits should apply to indigenous airlines only.

- 47% disagreed with a FG grant or bail out with no expectation of repayment.

- 44% disagreed that any airline receiving government support should not have to maintain staffing levels.

Post-COVID-19 industry changes needed

The Nigerian aviation sector has had a difficult history, over the years there has been a lot of expectation and potential which has not been achieved. Whilst being devastating to the Nigerian aviation industry, COVID-19 can equally be seen as an opportunity to rethink and restart the sector. We asked respondents what changes they would like to see in the post-COVID-19 era to improve the industry for the future. We have summarised the results below:

- 90% agreed airlines should be forced to improve corporate governance.

- 88% agreed NCAA should increase surveillance on financial health of airlines. NCAA should fully implement the guidelines on economic regulations of operators to assess economic viability of airlines.

- 72% agreed to the introduction of a guarantee fund, a Federal Government backed fund (for compliant and not indebted to government or service provider businesses.

- 71% agreed airlines and other private service providers needed access to a private sector (non-government) aviation fund.

- 67% agreed domestic operators should agree temporal or long term unity in passenger services and cargo operations in order to have strategic partnership and collaboration.

- 66% agreed the Government should encourage mergers between airlines by increasing minimum operational requirements.

- 64% agreed to recapitalisation of the sector by the FG with the Ministry, the Airlines and other critical relevant stakeholders to appoint an Independent Fund Manager.

- 63% wanted re-designation of all airports with gradient of fees/charges, for example: A, B, C and D. No landing/parking/air navigational fees for D; 50% fees at C; 75% at B and 100% at A.

- 58% wanted concession of all FAAN operated airports.

- 57% wanted concession of all secondary FAAN operated airports.

- 50% wanted privatisation of all secondary FAAN operated airports.

- 50% wanted privatisation of all airports with FG and/or State retaining a stake.

- 49% agreed that Nigeria does not need a national carrier (with government participation) at this time.

- 48% wanted full privatisation of all FAAN operated airports.

- 45% agreed the FG should discount the private carriers and focus its energy on establishing the national carrier.

In conclusion

Hard decisions need to be taken by the industry and the government. Actions need to be proactive and sensitive to passenger concerns. The obvious solutions such as social distancing on aircraft, to mitigate risks and encourage a return to the skies, may not be sustainable or an option when you consider aviation economics. A planned, strategic, and fully costed approach is needed. The economic and social cost of inactivity also needs to be considered.

Any response needs to be in sync with all stakeholders, including customers, airlines, service providers, regulators, and governments. The industry is optimistic of recovery, but Nigerian aviation does not operate in a vacuum, so what is needed is a global coordinated response to encourage and enable travel. Communication and increased awareness of mitigation activities must be part of the response of the Nigerian aviation industry. It is clear the industry must avoid unilateral decisions and unite to create passenger confidence and enable a sustainable business recovery to pre-COVID-19 levels and better, as soon as financially viable.

These survey results are provided for information purposes only. Avaero Capital Partners makes no warranties, express, implied or statutory, as to the information in this document.

CLICK TO DOWNLOAD > SURVEY RESULTS

For questions about this survey, or for more insights related to the impacts of COVID-19 on commercial aviation in Nigeria, please contact info@avaerocapital.com

Disclaimer: The insights shared in this article are for information purposes only and do not constitute strategic advice. Aviation markets and circumstances vary, and decisions should be based on your organisation’s specific context. For tailored consultancy and guidance, please contact info@avaerocapital.com.