Nigeria’s aviation sector is poised to drive economic growth, connect communities, and unlock regional potential. Yet, a critical challenge holds it back: low aircraft utilization hours, particularly for narrow-body aircraft that dominate domestic operations. Utilization—the hours an aircraft spends in revenue-generating flight daily—is the linchpin of airline economics. In Nigeria, where utilization lags global benchmarks, airlines face high costs, limited revenues, and constrained profitability. By addressing barriers and drawing lessons from global leaders, Nigeria can boost utilization, lower fares, expand air services, and create a thriving aviation ecosystem.

The High Cost of Low Aircraft Utilization

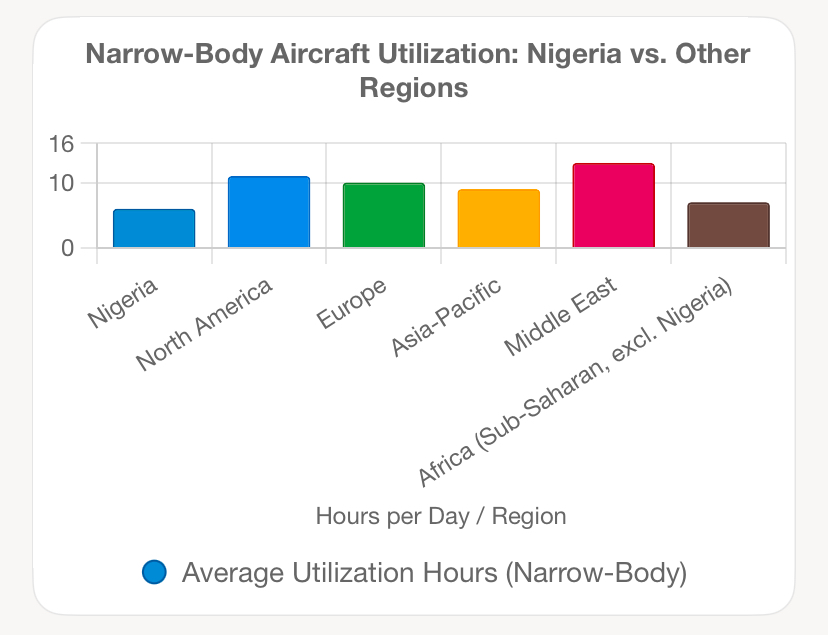

Aircraft utilization is a cornerstone of airline profitability. Globally, efficient carriers achieve 10–12 hours daily for narrow-body aircraft, such as the Boeing 737 or Airbus A320, according to McKinsey. In Nigeria, domestic airlines likely achieve 6–8 hours, based on regional trends and operational constraints. This gap profoundly impacts revenue, costs, profitability, and customer pricing.

Revenue Impact: Low utilization limits flight frequency, capping ticket sales. Consider a Boeing 737-800 with 160 seats, a 75% load factor (120 passengers), and an average domestic fare of $120. At 6 hours of utilization (two 1-hour flights with turnarounds), the aircraft generates $14,400 daily ($120 × 120 passengers × 2 flights). At 10 hours (four flights), revenue doubles to $28,800 daily—a $14,400 gain per aircraft. For a fleet of 10 aircraft, this translates to an additional $52.56 million annually (365 × $14,400 × 10). Nigeria’s restricted airport hours and low demand on non-core routes (beyond Lagos, Abuja, and Port Harcourt) limit such revenue opportunities.

Cost Burden: Fixed costs—leasing, crew salaries, and maintenance—dominate airline expenses. Leasing a 737 in Nigeria costs $150,000–$200,000 monthly, and maintenance abroad (e.g., $800,000 for a C-check) adds significant overhead. Low utilization spreads these costs over fewer flights, inflating the cost per available seat kilometer (CASK). For the 737-800, with fixed costs of $200,000 monthly ($6,667 daily), two flights daily yield a CASK of approximately $0.14 per seat-kilometer (assuming 500 km per flight). At four flights, CASK drops to $0.07, a 50% reduction. High CASK forces airlines to raise fares, suppressing demand and perpetuating low utilization.

Profitability Squeeze: Low revenue and high costs erode margins. Nigeria’s aviation sector contributes $940 million to GDP and supports 254,500 jobs, but profitability is elusive. High leasing costs, foreign exchange scarcity, and maintenance downtime (e.g., 30–60 days for overseas C-checks) limit fleet expansion. Airlines like Air Peace, Nigeria’s largest domestic carrier, struggle to scale, as thin margins restrict reinvestment. Low utilization creates a vicious cycle: high costs necessitate high fares, which reduce demand, further limiting utilization.

Customer Price Impact: High CASK drives elevated fares, often $100–$150 for a one-hour domestic flight. These prices exclude price-sensitive travelers, capping market growth. Higher utilization could lower CASK, enabling fares of $80–$100, stimulating demand and mirroring low-cost carrier (LCC) models globally.

The Transformative Power of Higher Utilization

Increasing narrow-body aircraft utilization offers a path to revolutionize Nigeria’s aviation sector. More flight hours boost revenue, reduce costs, enhance profitability, and enable lower fares and expanded services.

Revenue Growth: Higher utilization increases flight frequency, capturing more revenue. Using the 737-800 example, raising utilization from 6 to 10 hours adds $14,400 daily per aircraft, or $52.56 million annually for a 10-aircraft fleet. This revenue surge could fund fleet expansion, enabling airlines to serve more routes and passengers.

Cost Efficiency: Spreading fixed costs over more flights lowers CASK. In the 737-800 scenario, doubling flights from two to four reduces CASK by 50%, making operations more sustainable. This efficiency allows airlines to offer competitive fares, driving passenger volumes and further boosting utilization.

Profitability Boost: IATA estimates that a 1-hour increase in daily utilization improves operating margins by 1–2%. For Nigerian airlines, achieving 10–12 hours could turn loss-making routes profitable, enabling reinvestment in service quality and fleet growth. For example, a 10-aircraft fleet gaining 4 hours daily could add $10–20 million in annual profits, assuming a 2% margin increase.

Lower Fares and Market Expansion: Reduced CASK enables lower ticket prices, broadening the customer base. A 30% CASK reduction could cut fares from $120 to $84, attracting leisure and business travelers. This mirrors LCCs like Ryanair, which leverage 11–12 hours of utilization to offer fares as low as €20, driving passenger growth from 5 million in 2000 to 154 million in 2019. In Nigeria, lower fares could stimulate domestic tourism and regional connectivity, opening routes to cities like Enugu, Kano, or Calabar.

Service Expansion: Higher utilization supports more frequent flights and new routes. For instance, Air Peace could increase daily flights from Lagos to Abuja or launch services to underserved regions, boosting economic activity. Increased utilization also attracts investment, as profitable airlines secure better leasing terms, enabling fleet expansion and enhanced connectivity.

Global Benchmarks for Success

Global examples highlight the benefits of high narrow-body utilization, driven by extended airport hours and efficient operations:

• India (Delhi and Mumbai): IndiGo, India’s leading LCC, achieves 11–12 hours of utilization for its A320 fleet, enabled by 24/7 airport operations and liberalized policies. Low CASK allows fares as low as $30, driving passenger growth from 67 million in 2010 to 153 million in 2019 (DGCA India). This has expanded air services to tier-2 cities, boosting regional economies.

• United States (Dallas/Fort Worth): Southwest Airlines leverages 24/7 operations to achieve 11 hours of 737 utilization, offering fares as low as $49 on competitive routes. High utilization supports frequent flights, with Southwest operating over 4,000 daily flights, generating $24 billion in revenue pre-COVID.

• Europe (London Stansted): Ryanair’s high utilization (11–12 hours) and fast turnarounds at 24/7 airports like Stansted enable low fares and extensive route networks. This efficiency drove €8.5 billion in revenue in 2019, showcasing the power of maximized aircraft uptime.

In contrast, many of Nigeria’s airports face restricted hours due to inadequate lighting, air traffic control limitations, and security concerns, capping utilization and revenue potential.

Barriers and Policy Recommendations

To unlock higher utilization, Nigeria must address systemic barriers with targeted policies:

1. Restricted Airport Hours:

• Barrier: Limited operating hours at airports due to poor runway lighting and air traffic control shortages, restrict flight schedules.

• Policy: Invest $100–$150 million to upgrade key airports with CAT-III Instrument Landing Systems and 24/7 staffing. Extend operating hours to 20–24 hours by 2027, prioritizing airports with highest traffic demand.

2. High Operational Costs:

• Barrier: Leasing costs ($2 billion annually) and maintenance abroad increase downtime and expenses.

• Policy: Establish a local aircraft leasing company by 2026, supported by government-backed financing, to reduce costs by 20–30%. Partner with firms like Embraer to build MRO facilities, cutting maintenance downtime by 50%.

3. Low Demand on Non-Core Routes:

• Barrier: Traffic concentration in Lagos, Abuja, and Port Harcourt limits route expansion.

• Policy: Launch a “Fly Nigeria” tourism campaign by mid-2026, offering tax incentives to airlines serving tier-2 cities, increasing demand by 15–20%. Extend economic capacity growth to other regions.

4. Regulatory Delays:

• Barrier: Bureaucracy and stalled policies, like the Aviation Development Roadmap, hinder efficiency.

• Policy: Fully deregulate the sector by 2025, streamlining licensing and concessions. Create a public-private partnership framework to attract $1 billion in infrastructure investment by 2028.

A Call to Action

Nigeria’s aviation sector can soar by prioritizing narrow-body aircraft utilization. Achieving 10–12 hours daily could add $50–$100 million in annual revenue per airline, lower fares by 20–30%, and expand services to underserved regions. The economic impact—potentially $2–$3 billion in GDP and thousands of new jobs—is transformative. By adopting global best practices and implementing bold policies, Nigeria can become West Africa’s aviation hub. The question is not whether it can afford to act, but whether it can afford to wait.

About the Author

Sindy Foster is Principal Managing Partner at Avaero Capital Partners, an aviation advisory firm focused on strategy, economics and operating performance across African and emerging aviation markets.

Her work centres on the structural drivers of airline performance — including capacity, pricing, operational resilience and system design. She advises airlines, investors and public-sector stakeholders on translating operating constraints into sustainable commercial outcomes.

Disclaimer: The insights in this article are for informational purposes only and do not constitute strategic advice. Aviation markets and circumstances vary, and decisions should be based on your organization’s specific context. For tailored consultancy, contact info@avaerocapital.com.