African aviation stands at a crossroads. While the continent’s young population, expanding middle class, and growing economic activity signal immense potential, its airlines grapple with structural challenges—high operating costs, regulatory fragmentation, and limited connectivity. Yet, one critical opportunity remains largely untapped: ancillary revenue. The 2024 CarTrawler Yearbook of Ancillary Revenue by IdeaWorksCompany reveals a stark global disparity, with African airlines trailing far behind their peers in Europe, The Americas, and Asia and the South Pacific. This gap represents not just missed revenue but a strategic failure to leverage a proven driver of profitability, as exemplified by industry leaders like Emirates. For African carriers, unlocking ancillary revenue is not optional—it’s a strategic imperative to achieve financial resilience and global competitiveness.

The Ancillary Revenue Gap: Africa’s Missed Opportunity

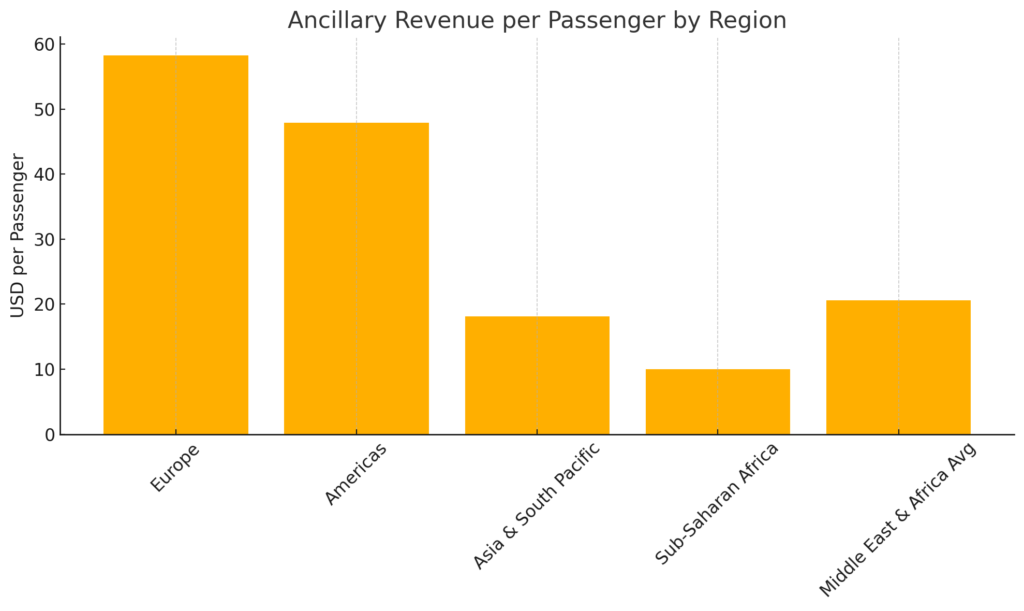

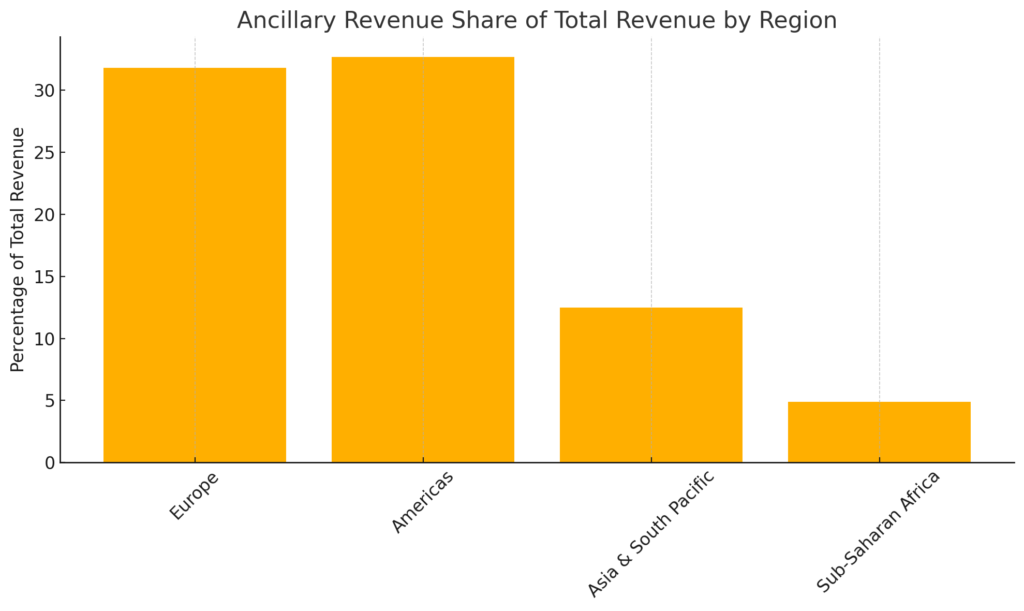

Ancillary revenue—derived from non-ticket sources like baggage fees, seat selection, loyalty programs, and onboard sales—has become a cornerstone of airline profitability worldwide. The 2024 CarTrawler Yearbook highlights the scale of this opportunity. In Europe, airlines average $58.23 per passenger in ancillary revenue, contributing 31.8% of total revenue. The Americas follow closely with $47.91 per passenger and 32.7%. Even Asia and the South Pacific, with a more conservative approach, generate $18.09 per passenger and 12.5% of revenue. In contrast, sub-Saharan African airlines, lacking specific data in the Yearbook, are estimated to generate less than $10 per passenger and under 5% of total revenue, based on the region’s low adoption of ancillary strategies and the broader Middle East and Africa average of $20.63 per passenger (skewed by Middle Eastern carriers like Emirates and Qatar Airways).

This disparity translates into billions in lost revenue. Consider a hypothetical 50 million passengers annually across African carriers—a conservative estimate given 2023 global traffic trends. Matching Asia’s $18.09 per passenger could yield $904.5 million annually, while approaching The Americas’ $47.91 could generate $2.4 billion. With African carriers likely earning less than $500 million from ancillaries (assuming $10 per passenger), the gap exceeds $1.9 billion annually. This lost opportunity undermines financial stability, limiting investments in fleet modernization, infrastructure, and service quality—key pillars of Emirates’ success, which reported a record $5.8 billion pre-tax profit for the year ending March 31, 2025.

Several factors drive this gap. Intra-African routes often operate as monopolies or duopolies, reducing competitive pressure to innovate, unlike Europe’s vibrant low-cost carrier (LCC) market. High operational costs, including fuel prices 30-40% above global averages and elevated airport fees, constrain capital for ancillary initiatives. Thin passenger volumes, due to fragmented networks and restrictive visa policies, hinder the scale needed for profitable ancillary programs. Finally, African airlines have been slow to adopt the sophisticated loyalty programs and a la carte pricing that fuel revenue in other regions, as seen with carriers like Spirit (56.4% of revenue) and Delta ($34.50 per passenger from SkyMiles).

Lessons from Global Leaders and Emirates

Emirates, while not a perfect analog, offers valuable lessons for African carriers. Its ancillary revenue of $34.26 per passenger and 5.4% of total revenue (2024 CarTrawler Yearbook) is modest compared to LCCs but significant given its premium positioning. Emirates leverages its Skywards program (30+ million members), duty-free operations, and travel services to diversify income, contributing to its industry-leading profitability. This aligns with broader global trends: US majors like Delta and United generate billions from co-branded credit cards, while LCCs like Jet2.com ($95.83 per passenger) excel through a la carte fees and package holidays.

African carriers can draw inspiration from these models while adapting to their unique context. Emirates transformed Dubai’s geographic advantage into a global hub, a strategy Ethiopian Airlines has emulated in Addis Ababa. However, most African carriers lack the scale or infrastructure to replicate this immediately. Instead, they must focus on incremental, high-impact ancillary strategies that address local realities—low per capita income, fragmented markets, and digital adoption.

Strategic Imperatives for African Airlines

To close the ancillary revenue gap, African airlines must pursue a comprehensive, context-specific strategy. The following imperatives, informed by global best practices and tailored to Africa’s challenges, offer a roadmap to unlock this goldmine.

1. Build Scalable Loyalty Programs

Loyalty programs are a proven revenue driver, with US carriers like Southwest ($41.88 per passenger) and Air Canada ($28.29) reaping billions. African airlines must develop basic frequent flyer programs tailored to local markets. Partnerships with mobile payment platforms like M-Pesa or local banks can enable mileage accrual for everyday purchases, mirroring Qantas’ model (35% of Australian credit card spending). Start with simple tiers offering priority boarding or baggage discounts, as T’way Air’s T’way Plus demonstrates, to foster repeat business. Over time, co-branded credit cards can scale revenue, as seen with Azul’s TudoAzul ($30.33 per passenger).

2. Implement A La Carte Pricing

A la carte services—baggage fees, seat selection, and onboard sales—drive significant revenue for LCCs like Spirit (56.4%) and Frontier (56.2%). African carriers should introduce modest fees tailored to regional travel patterns, such as family bundles (inspired by Aegean’s Family fare) or luggage protection for rural routes. Dynamic pricing, as practiced by US majors, can optimize yields without alienating price-sensitive passengers. For example, IndiGo’s $5.54 per passenger shows that even low-cost markets can generate meaningful ancillary income with targeted offerings.

3. Leverage Digital Platforms

Africa’s leadership in mobile payments and growing smartphone penetration offer a unique advantage. Airlines should invest in mobile apps to streamline ancillary sales, following Philippine Airlines’ 297% user growth and 2.14% sales contribution from its app. Partnerships with firms like CarTrawler can integrate car rentals or hotel bookings, adapting Emirates’ travel services model ($633 million). Promotions, such as Jin Air’s $4 vouchers for coat storage, can drive uptake, tailored to African needs like pre-booked meals or visa assistance.

4. Advocate for Regulatory and Cost Relief

High operational costs—fuel, airport fees, and navigation charges—limit ancillary investment. Airlines must advocate for the Single African Air Transport Market (SAATM) to liberalize skies, fostering competition and passenger volumes, akin to Europe’s open-skies model. Negotiating with governments to reduce fees and improve fuel supply chains, as Emirates benefits from in Dubai, can free capital for ancillary initiatives. These reforms are critical to achieving the scale needed for profitable programs.

5. Innovate with Local Relevance

African carriers can differentiate through region-specific offerings. For example, partnerships with tourism boards to promote new destinations, as Emirates does with Dubai, can boost traffic. Specialized cargo services, leveraging Africa’s agricultural exports, can mirror Emirates SkyCargo’s profitability. Unique services like Jeju Air’s bicycle case rentals could be adapted as luggage storage for cross-border traders or sustainable fuel subsidies for eco-conscious travelers, aligning with airBaltic’s approach.

The Path to Transformation

The ancillary revenue gap is not just a financial shortfall—it’s a missed opportunity to transform African aviation. The $1.9 billion annual potential, even at Asia’s modest $18.09 per passenger, could fund fleet modernization, infrastructure upgrades, and service enhancements, aligning with Emirates’ blueprint of efficiency, quality, and government alignment. Unlike Emirates, African carriers face lower incomes and fragmented markets, but their digital savviness and demographic growth provide a foundation for innovation.

The Emirates effect demonstrates that strategic execution trumps market challenges. African airlines must move beyond ticket sales, embracing ancillary revenue as a core competency. This requires bold leadership, regional cooperation, and a willingness to experiment. The continent’s aviation pioneers—Ethiopian Airlines, Kenya Airways, South African Airways—have the opportunity to lead this transformation, creating world-class carriers that reflect Africa’s potential.

By building loyalty programs, implementing a la carte pricing, leveraging digital platforms, advocating for reforms, and innovating locally, African airlines can unlock a revenue goldmine. The blueprint is clear. The stakes are high. The time to act is now.

About the Author

Sindy Foster is Principal Managing Partner at Avaero Capital Partners, an aviation advisory firm focused on strategy, economics and operating performance across African and emerging aviation markets.

Her work centres on the structural drivers of airline performance — including capacity, pricing, operational resilience and system design. She advises airlines, investors and public-sector stakeholders on translating operating constraints into sustainable commercial outcomes.

Disclaimer: The insights in this article are for informational purposes only and do not constitute strategic advice. Aviation markets and circumstances vary, and decisions should be based on your organization’s specific context. For tailored consultancy, contact info@avaerocapital.com.