Africans make up 12% of the world’s population, but only 2.5% of the world’s passengers. According to the ICAO’s long term forecast, passenger traffic for the Africa region is expected to grow by around 3.8% annually up to 2032. Whilst passenger numbers are important, aviation expansion combined with an increase in cargo facilities, facilitiates trade between countries. Currently Africa has only 10% intra-continental trade.

The International Air Transport Association (IATA) has projected that the African continent will become one of the fastest growing aviation markets within the next 20 years, with an average expansion rate of 4.6% annually.

Currently there are 731 airports and 419 airlines on the African continent. The aviation sector supports seven million jobs and generates $80bn in economic activity. 47 million passengers departed from Africa’s top five airports in 2018.

The top ten fastest growing markets in Africa are: Sierra Leone, Guinea, Central African Republic, Benin, Mali, Rwanda, Togo, Uganda, Zambia and Madagascar.

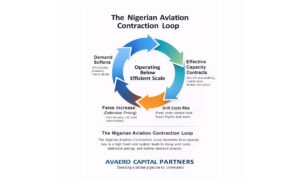

Africa is anticipated to see an extra 192 million passengers a year, 303 million passengers travelling to and from African airports. Foreign airlines dominate the African aviation landscape. African airlines have continued to suffer with many going into administration or being lost completely. Profitability is very hard to achieve in an often inconsistent environment. Ethiopian is currently the African market leader with 9% market share, this may change now that Qatar has partnered with an African airline, Rwanda Air. Emirates is the largest foreign airline in Africa.

But Africa has a problem which cannot be ignored if it is to achieve its potential.

To facilitate growth

- Africa needs a better pipeline to well developed projects.

- Changes to regulations and national policies to mitigate risk

- In-sector collaboration and facilitation

- More co-operation and standardization between countries

- Solid cross-border investment principles.

The aviation sector is widely anticipated to become one of the key drivers of economic activity in Africa. But several barriers exist and need to be addressed for Africa to reach its potential.

Leadership

Leadership drives confidence in a company, a country and a continent. Africa suffers from a leadership issue at all levels. Poor leadership cannot deliver the credibilty which a capital intensive sector such as aviation requires. There needs to be clear directives from the top to create the enabling environment for Africa to reach its potential.

Credit worthiness

When looking to invest in Africa it is not always easy to have a clear understanding of the business and the individuals concerned. Even governments do not escape the fear of credit worthiness, with governments owing trillions of dollars to businesses across the continent. Security is often an issue where land, company and property ownership is still unclear.

Trust

Africa has a trust issue across the board. Consumers are skeptical about airlines and airports. All issues are widely spread these days on social media, so businesses need to work harder to gain trust. Especially when there are other options.

Businesses don’t trust their governments due to policy flip flops, perceived lack of facilitation and corruption from key officials. In this environment, it is hard for a foreign investor or JV partner to understand what is genuine or not. Sticking to contracts, clearly indicating changes of policy with an implementation timeframe, rather than announcing policy changes which have a huge cost implication with immediate (or retrospective) effect.

Transparency

In order to do business, any business, the transaction needs to be clear. Investors need to see a clear path to the transaction and what the risks are. Investors need to be clear who the regulators are and what their role is. They need to know who are the owners or people with beneficial interest in a company.

Competitiveness

Around the world low-cost carriers (LCCs) amount to around 25% of all flights, within Africa it was 12% in 2018, whilst to/from Africa is 16% (which consists mostly of services connecting North Africa and Europe).

Ease of Doing Business tracks how easy it is to do business around the world. Africa often fairs badly, and this cited as a rationale to avoide doing business in Africa. But sometimes what is required is a deeper dive into the figures to see if the data is meaningful for your individual perspective. This affects high rankings as well as low rankings. The devil is in the detail and the proof of the pudding is in the eating has never been more apt!

Education and productivity drives competitiveness in complex sectors. Increasing education and training at all levels, will increase productivity and help Africa become more competitive in the future.

Stability

Stability of exchange rate and access to foreign exchange is more of an issue when the majority of your costs are in $s and your revenue is in a local currency. Political stability is required first before business agree to invest in a business, country or even sometimes a region! The entire region has been written off by some investors.

Stability of aviation businesses in Africa (or lack of) is often cited as an issue with people able to count numerous companies who were at one time prosperous, but are no more.

Economic stability if that is combined with poor economic growth is not a good thing. Stable growth rates are preferable to a stable but stagnant economy or sector.

Regulations and Policy

Governments have an important role to play in delivering economic benefits and enabling the sustainable growth in African aviation. Ownership, regulations to attract foreign investment and visa policies to increase mobility and encourage travel within the continent would be beneficial to all countries in Africa. Fees and taxes are often used as artificial barriers to competition. Issues around certificates of capital importation can be an issue for investors. And if it is an issue for investors, it should be an issue for governments as well.

Protectionism

The sector faces significant challenges as protectionist tendencies are rife within Africa. Even the signing of the Single African Air Transport (SAATM) by 28 countries out of 55 African Union member states, hasn’t removed the fear of protectionism. The signing of the African Free Trade Agreement followed by the closing of the Nigerian land borders has not left many feeling optimistic about changes in mindset which is necessary for liberalisation to achieve economic benefits for Africa.

Consumer Rights

Common rules on compensation, denied boarding, flight cancellations, or long flight delay in Europe protects consumers rights. Passengers are aware of the rules and they are enforced by the Europeaan Court of Justice. A sector which does not protect its customer can never grow as fast as one where there is trust, mutual expectation and respect.

In conclusion

While challenges clearly exist, so do opportunities. Private Public Partnerships (PPP) have delivered great value and economic benefit for African aviation around the continent in a variety of sectors. More PPPs will enable the aviation infrastructure gap to be closed, increase and improve operations. Combined with ‘genuine’ open skies initiatives and visa liberalisation, will be the direction to grow.

Disclaimer: The insights shared in this article are for information purposes only and do not constitute strategic advice. Aviation markets and circumstances vary, and decisions should be based on your organisation’s specific context. For tailored consultancy and guidance, please contact info@avaerocapital.com.