What Nigeria's Aviation Sector Should Be Talking About

Over the past few weeks, Nigeria’s aviation sector has been buzzing—not with the sound of jets overhead, but with disagreement on the ground.

According to data shared in a recent news reports, the Nigerian Civil Aviation Authority (NCAA) have publicly clashed with airline operators over official performance data. NCAA figures show a sharp rise in domestic flight disruptions between 2021 and 2024, with over 33,000 delays and more than 1,100 cancellations recorded in 2024 alone (reported figures vary). Several carriers have pushed back—challenging the accuracy of those figures and sharing alternative data from their own records.

At first glance, it may seem like a debate over numbers. But the real issue isn’t just the data, or the lack of unified data. It’s what those delays are costing the sector—and how little attention that’s getting.

The Cost of Delay is the Bigger Problem

Disruption—whether it’s a delay, cancellation, or diversion—has tangible financial implications. It affects crew scheduling, fuel costs, passenger compensation, loyalty, and operational throughput. And the impacts are felt by everyone: airlines, ground handlers, airport authorities, and the flying public.

To understand the magnitude of the issue that delay-related disruption might be creating, Avaero Capital Partners created the OTP Uplift Model, a financial tool that estimates the potential value the Nigerian aviation sector could unlock by improving on-time performance (OTP) by just 10%.

Using publicly available NCAA data, and globally accepted benchmarks, the analysis showed that poor OTP lost up to ₦215 billion in value in 2024—a figure equivalent to several percentage points of the industry’s total operating costs.

But here’s where it gets interesting: when airlines’ self-reported data is used instead of NCAA data, the cost picture changes.

What the Data Discrepancy Reveals

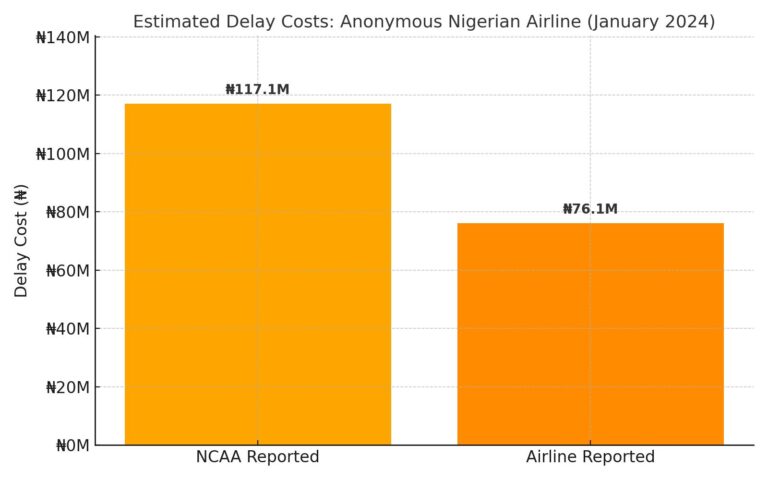

For illustrative purposes only

Using a conservative ₦100,000 value lost per delayed or cancelled flight, here’s how that discrepancy plays out for one airline. Similar gaps exist across other airlines. These are not small differences—and they suggest that the true cost of delay or cancellation, and the value lost, may be misunderstood, under or over-reported, or inconsistently measured.

A Solvable Part of The Problem: No Shared Definition of ‘Disruption’

At the heart of the discrepancy is not deception—but definition.

What constitutes a delay? Does it start at 15 minutes? 30 minutes? 60 minutes? Do airlines count delays from scheduled time or actual gate departure? What qualifies as a cancellation? If a flight is removed from the system before the day of operation, does it count?

Without an agreed framework for disruption reporting, different stakeholders will continue to publish conflicting data. This erodes trust, confuses consumers, and makes it harder to implement national-level reforms.

Nigeria needs a sector-wide data standard for disruption classification—one that’s jointly defined by airlines, regulators, airports, and service providers. That’s the foundation of any serious OTP improvement strategy.

OTP is Not Just an Operational Metric—It’s a Strategic Lever

Many still treat OTP as a secondary indicator—something to review quarterly, or post on a dashboard.

But poor OTP affects:

- Brand reputation: Every delay is a potential lost customer, both existing and potential future.

- Passenger confidence: Especially in a price-sensitive market, competitive market. Perceived reliability can make or break market share.

- Increased costs and lost revenue: Delays ripple across rotations, causing inefficiencies.

- Regulatory exposure: The NCAA’s consumer protection regulations now impose obligations for meal vouchers, rerouting, and even accommodation when delays stretch past certain thresholds.

- Financial leakage: Fuel wastage, underutilised aircraft hours, missed connections, rebooking—all hit the bottom line.

If OTP were viewed as a core part of the profit-and-loss statement, the conversation would change overnight.

From Dispute to Dialogue: What Avaero Recommends

This analysis isn’t about taking sides. It’s about moving forward. Avaero recommends the following steps for sector-wide OTP transformation:

- Create a standardised definition of ‘disruption’. Airlines and regulators must align on what counts as a delay or cancellation, and how it’s recorded.

- Implement independent OTP baselining. A neutral party should validate performance data quarterly across airlines and airports (or make it a regulatory requirement with penalties for failure to adhere as required)

- Invest in real-time data tracking and reporting

- Operational control centres (OCCs), OTP committees, and digital dashboards should all work from the same truth.

- Treat OTP as an investment area. Create value to enhane profitability.

- Create OPT Taskforce(s). Don’t just count the numbers – analyse them, set a target, make changes and track performance over time.

Agree What to Count! Then Start Solving!

Yes, data discrepancies matter. But not just identified as existing. They should be addressed, clarified, and standardised.

That’s just part of the disconnect. The bigger issue is this: Nigerian aviation is losing money to disruption—every day.

Whether the value lost is ₦180 billion or ₦215 billion, doesn’t change the fact that passengers are frustrated, crews are misaligned, and the system is under pressure.

It’s time to shift from counting delays to correcting them. That starts with aligned data, shared accountability, and an honest conversation about what’s really costing us.

The numbers may differ.

But the need for action is no longer up for debate.

Disclaimer: The insights shared in this article are for information purposes only and do not constitute strategic advice. Aviation markets and circumstances vary, and decisions should be based on your organisation’s specific context. For tailored consultancy and guidance, please contact info@avaerocapital.com.