A Call to Action for Regional Airlines

South America’s aviation sector stands at a critical juncture. While global carriers increasingly rely on ancillary revenue to bolster margins amid volatile demand and rising costs, most South American airlines lag far behind, leaving billions in potential revenue untapped. This Avaero Insights analysis, informed by the 2024 CarTrawler Yearbook of Ancillary Revenue by IdeaWorksCompany, explores why the region underperforms, highlights the success of pioneers like Azul and Avianca, and offers a strategic roadmap for commercial teams to seize this opportunity. With economic pressures mounting and passenger expectations evolving, the time to act is now.

South America’s airline industry faces a familiar margin squeeze: fare competition, inflationary cost structures, and currency fluctuations erode profitability. Yet, unlike their North American and European counterparts, many carriers in the region treat ancillary revenue – earnings from baggage fees, seat selection, loyalty programs, and other à la carte services – as an afterthought rather than a strategic imperative. The 2024 CarTrawler Yearbook reveals a stark disparity: while global leaders like Spirit and Frontier generate over 50% of their revenue from ancillaries, South America’s average hovers below $10 per passenger, excluding standout performers. This gap represents not just a missed opportunity but a structural vulnerability that threatens long-term viability.

Pioneers Paving the Way: Azul and Avianca Lead the Charge

Amid this regional lag, Azul and Avianca stand out as beacons of progress. According to the 2024 Yearbook, Azul reported $887.9 million in ancillary revenue for 2023, translating to $37.4% of total revenue and $30.33 per passenger – a figure that rivals global low-cost carriers (LCCs). Avianca, meanwhile, generated $299.7 million, or $9.38 per passenger, with its LifeMiles loyalty program driving significant upside. These airlines succeed not due to geographic advantage but through deliberate commercial strategies. Azul leverages its TudoAzul program, boasting 17 million members and $52.21 per member from point sales, while Avianca’s 12.5 million LifeMiles members and 500,000 co-branded cardholders underscore a robust loyalty ecosystem. Both have integrated ancillaries into their core business models, bundling services, optimising retail channels, and monetising customer data – lessons the region’s other carriers must heed.

The Barriers Holding South America Back

Why have most South American airlines failed to follow suit? The challenges are multifaceted. Outdated technology stacks hinder seamless e-commerce integration, while fragmented payment systems and poor mobile user experiences deter ancillary purchases. However, the deeper issue lies in mindset. Many carriers view ancillaries as secondary revenue streams or politically sensitive due to passenger backlash against fees. Commercial teams, often trained in traditional yield management, lack expertise in travel retail and offer design. Moreover, loyalty programs remain underutilized, with data siloed rather than leveraged for personalized upsells. The 2024 Yearbook notes that non-reporting carriers like LATAM and Aerolíneas Argentinas – major players in the region – offer limited transparency, suggesting a reluctance to embrace ancillary revenue as a priority. This inertia perpetuates a yield-first mentality ill-suited to today’s consumer-driven market.

The Numbers Unveil the Opportunity

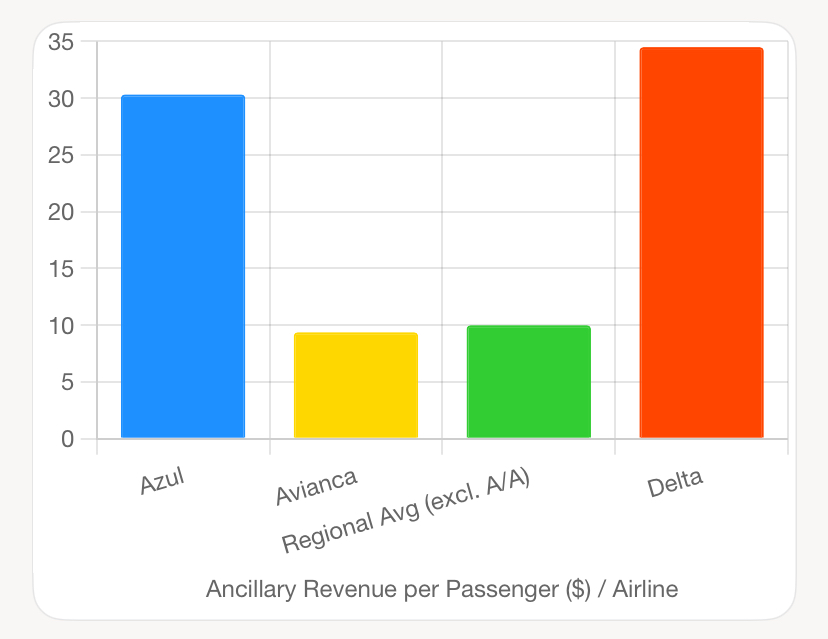

The data paints a compelling picture. Excluding Azul and Avianca, South America’s ancillary revenue per passenger languishes below $10, a fraction of the $35–50 achieved by North American majors and LCCs. To illustrate, consider the following comparison based on 2023 figures from the CarTrawler Yearbook:

This chart underscores the gap: while Azul and Delta approach parity with global leaders, the regional average lags significantly. With South America’s passenger traffic estimated at over 200 million annually (per the 2024 Big Book of Airline Data), even a modest increase to $20 per passenger could unlock $2–3 billion in additional revenue – funds critical for fleet modernisation and network expansion.

The Urgency of Action in a Challenging Landscape

The commercial environment offers no respite. Rising interest rates, inflation, and currency volatility – exacerbated by Brazil’s real and Argentina’s peso depreciation – compress margins. Premium demand softens as economic uncertainty grows, yet ancillary revenue provides a buffer independent of fleet size or route density. The 2024 Yearbook highlights that global ancillary growth outpaced passenger traffic in 2023 (25.7% versus 25.1%), a trend South America must replicate. Delay risks entrenching a cost-driven model that stifles innovation and competitiveness.

A Strategic Roadmap for Transformation

South American airlines can turn the tide with actionable steps:

• Audit Ancillary Gaps: Assess offerings – baggage, seating, meals, lounge access, and cargo – against regional leaders. The 2024 Yearbook notes AirAsia X’s $16.72 per passenger from baggage fees, a benchmark for optimization.

• Rebuild Branded Fare Ladders: Design tiered products (e.g., basic, plus, premium) with clear upsell logic, as Azul does with TudoAzul bundles.

• Train Teams in Travel Retail: Shift focus from yield management to retail psychology, enhancing offer presentation and conversion rates.

• Activate Loyalty Data: Monetize programs through partnerships and co-branded cards, mirroring Avianca’s success with LifeMiles.

• Start Small, Scale Smart: Pilot initiatives on high-traffic routes, test pricing elasticity, and optimize based on data—avoiding the pitfalls of overambitious rollouts.

Ancillaries as the Margin Multiplier

South America’s airline industry cannot rely on base fares alone to ensure sustained profitability. The economics of the region—marked by volatile demand and tight margins—demand a pivot to ancillary revenue as a core strategy. Azul and Avianca demonstrate that success is achievable through intentional design, not geographic luck. The $2–3 billion opportunity highlighted here is not a theoretical exercise but a practical imperative. By embracing technology, retraining commercial teams, and leveraging loyalty ecosystems, South American carriers can unlock this missed margin. The question is not whether they can afford to act, but whether they can afford to wait. As the global aviation landscape evolves, those who seize this opportunity will define the region’s future competitiveness.

About the Author

Sindy Foster is Principal Managing Partner at Avaero Capital Partners, an aviation advisory firm focused on strategy, economics and operating performance across African and emerging aviation markets.

Her work centres on the structural drivers of airline performance — including capacity, pricing, operational resilience and system design. She advises airlines, investors and public-sector stakeholders on translating operating constraints into sustainable commercial outcomes.

Disclaimer: The insights in this article are for informational purposes only and do not constitute strategic advice. Aviation markets and circumstances vary, and decisions should be based on your organization’s specific context. For tailored consultancy, contact info@avaerocapital.com.