Trust is the quiet heartbeat of aviation, threading through every passenger stepping aboard, every regulator issuing a certification, and every investor weighing a stake. In Nigeria, where the aviation sector pulses with potential yet grapples with distinct challenges, this intangible asset is more a fragile hope than a sturdy pillar. As the industry navigates operational hurdles and eyes a stronger global presence, understanding the delicate interplay of trust—its drivers, its costs, and its rewards—becomes a compass for progress. It is clear, with fresh events unfolding every week, that ‘trust – the unseen force’ in aviation has faltered, so let’s look at what it will take to rebuild it as we move through mid-2025.

The Rhythm of Reliability and Reassurance

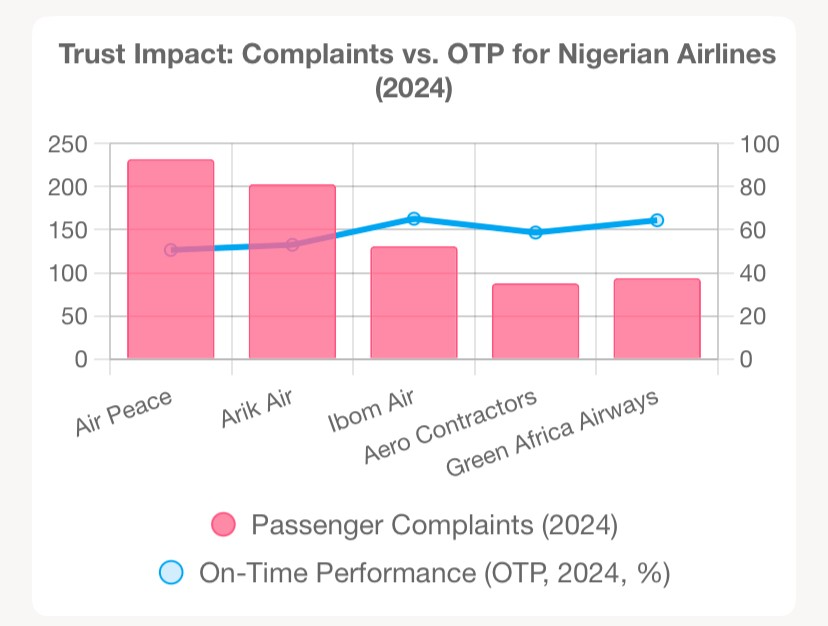

At the core of passenger trust lies the expectation of a smooth journey. Recent analyses of domestic operations, drawn from 2024 Nigeria Civil Aviation Authority (NCAA) data, reveal a clear pattern: airlines with delay rates topping 50% of their flights face a flood of complaints, often sparked by late arrivals, cancellations, and unclear communication. Those holding delays below 40%—per a 2024 performance review—tend to hear fewer grievances, suggesting reliability nurtures confidence. The NCAA recorded 2,184 passenger complaints in 2024, with flight irregularities at the forefront, resolving 981 cases (44.98%). The unresolved half, however, keeps distrust simmering among travelers.

NCAA 2024 Report: Cited for 2,184 complaints, 981 resolved (44.98%) broken down by airline (nigerianflightdeck.com)

Flight Delay Table: Referenced for delay percentages (e.g., >50%, <40%) to imply OTP-complaints link

This link offers a practical lever. A 10-15% uptick in on-time performance (OTP), derived as 100% minus delay rates from the 2024 review, could trim complaints by a similar margin, easing passenger frustration. It’s a matter of perception as much as performance—when flights run like clockwork, trust builds; when they falter, it frays. This dynamic was starkly illustrated in a recent incident, where a passenger arriving 25 minutes before departure missed his flight, allegedly blocked the counter and entrance, and is quoted as stating the airline resold tickets at higher prices. The facts, based on his account, show a delay to subsequent flights, yet the carrier’s perspective—potentially tied to safety or scheduling constraints—has been drowned out by public backlash. This episode underscores how trust erodes quickly, especially in an industry where reliability is judged by the most recent experience.

Yet, trust doesn’t materialize or indeed evaporate overnight. It’s forged (or destroyed) through a series of interactions—firsthand experiences like timely flights or third-hand opinions shaped by media and word of mouth. In Nigerian aviation, a reactive approach dominates, with trust-building rarely embedded as a strategic priority. The benefit of the doubt has a narrow window; once broken, as it largely has been across the board, restoring it becomes a strategic imperative for the airlines and the wider industry in general. Each delay or mishandled incident chips away at credibility, demanding a proactive shift to rebuild confidence through consistent, positive engagements.

The Broader Tapestry of Trust

Trust in Nigerian aviation stretches beyond the airline, woven into a richer fabric of systemic and relational threads. Safety remains a lingering concern, despite progress. The NCAA’s alignment with International Civil Aviation Organization (ICAO) standards and its State Safety Programme, outlined in the 2024 executive summary, signal improvement. Yet, sporadic incidents and perceived enforcement gaps—echoed in industry chatter—undermine regulatory credibility. This mutual distrust between airlines and overseers can turn oversight into a standoff, hindering the agility needed to compete globally.

Financial strains add weight. The sector’s reliance on high-cost debt and wet leases, where aircraft come with crew and maintenance, reflects hesitancy from lessors and investors. Dry leases stay out of reach, while demand for spare parts or end-of-life aircraft from Nigeria stalls, hampered by doubts over local certifications. Negative media, quick to spotlight disruptions over triumphs, feeds this caution, deterring equity and partnerships. It’s a loop where distrust fuels restraint, and restraint deepens the gap.

Workforce trust wavers too. Job security and training quality concerns can erode morale, sparking turnover that ripples into service. Cultural perceptions, with Nigeria’s Corruption Perception Index at 26/100 ranking it 140 out of 180 countries, as reported by Transparency International, layer on skepticism, complicating the trust equation. These broader issues don’t just shadow operational struggles—they amplify them, demanding a holistic response.

Quantifying the trust dividend is slippery, but proxies light the way. Customer loyalty, measured by repeat bookings is a blunt indicator of passenger confidence in the face of alternatives. While exact revenue gains from performance aren’t pinned down here, global trends suggest reliability and trust drives demand and load factor and therefore revenue—a key for Nigeria’s ascent. These indicators, though not fully monetized, underscore trust’s role in operational and passenger resilience.

Weaving a Stronger Trust Fabric

Rebuilding trust demands a woven strategy, blending operational fixes with perceptual shifts. Transparency could begin with a public dashboard tracking OTP and complaint resolutions—mirroring the UK Civil Aviation Authority’s model. The regulator might bolster this by sharing ICAO audit outcomes, cutting through opacity. During disruptions, like the recent passenger incident, clear communication via apps or social media could turn frustration into understanding. Even before incidences communication is key to ensure responsibility and information is clearly communicated. The regulator via consumer protection has a role to play, as the role of the NCAA is not just to regulate airlines (as appears to be the current perception and understanding of public and some stakeholders).

Investment in workforce training, particularly of front-line staff in customer service, dispute resolution and crisis management, could steady morale and improve customer experience. Highlighting successes, like the NCAA’s 99.77% baggage recovery rate in 2024, could reshape narratives. These steps carry costs—cultural shifts may span years—but the payoff, from improved operations to renewed confidence, justifies the effort. Coordination among regulators, carriers, and government will be the thread that binds it, with trust-building woven into every strategy to counter the reactive tendencies of the past.

A Horizon of Trust

Trust in Nigerian aviation is a challenge rooted in performance gaps, regulatory tensions, financial strains, and cultural currents. The OTP-complaint correlation, evident in 2024’s 2,184 grievances, mirrors global patterns, sharpened by local complexities. The recent incident, where a late passenger’s actions and allegations sparked a trust storm, highlights how quickly perceptions can shift—and how vital consistent, proactive engagement is. Once trust is broken across the board, as it largely has been, it becomes a strategic imperative to rebuild through every interaction. By enhancing reliability, deepening transparency, and tackling systemic issues, the industry can lay a foundation for trust to lift Nigeria’s aviation higher. Trust – the unseen force, though currently strained, holds the promise of transforming hurdles into a thriving future. What is required is action….

About the Author

Sindy Foster is Principal Managing Partner at Avaero Capital Partners, an aviation advisory firm focused on strategy, economics and operating performance across African and emerging aviation markets.

Her work centres on the structural drivers of airline performance — including capacity, pricing, operational resilience and system design. She advises airlines, investors and public-sector stakeholders on translating operating constraints into sustainable commercial outcomes.

Disclaimer: The insights in this article are for informational purposes only and do not constitute strategic advice. Aviation markets and circumstances vary, and decisions should be based on your organization’s specific context. For tailored consultancy, contact info@avaerocapital.com.