Nigeria is a major hub for business and commercial activities in Africa. It is also Africa’s most populous country with a ‘suspected’ population of c.200 million, therefore it is a logical destination for a successful aviation investments. The belief is regardless of whether opportunities are in cargo or airline or passenger services the need for these services are going to grow.

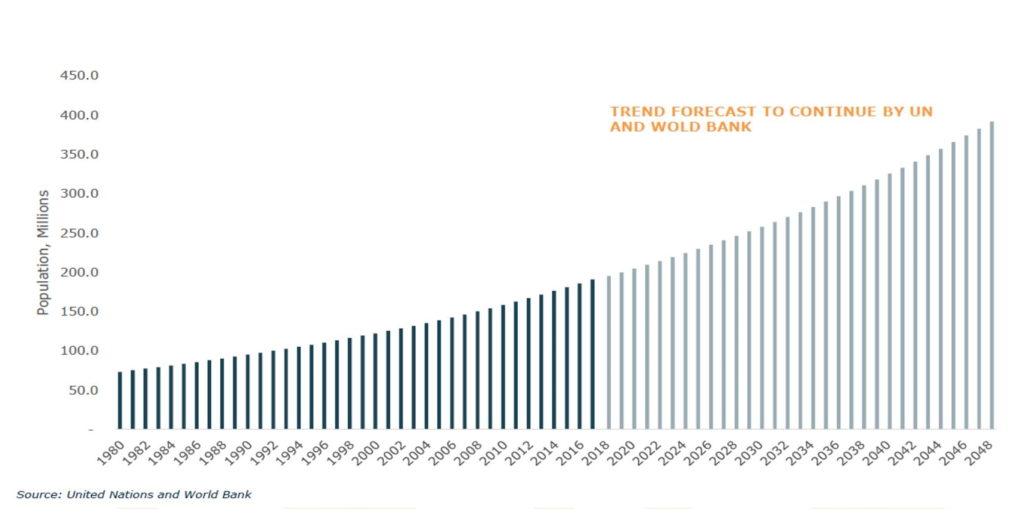

As population size grows, the economy needs to grow to meet increasing needs and provide increasing income. It is widely anticipated that this in turn will lead to a growing middle class who need and desire to travel within Nigeria, across the region and internationally.

The Nigerian aviation sector currently contributed N149.4 billion to the economy in 2018. The FG’s expressed their ambition for the aviation sector to contribute over N1.2 trillion to Nigeria’s GDP by 2020.

Civil aviation is a critical element in Nigeria’s transportation system and the economy.

The Nigerian economy

Nigeria has the largest economy in Africa, with a gross domestic product (GDP) of $398,186 million.

Sources: ATAG – Aviation Benefits Beyond Borders, 2014; Oxford Economics: Economic Benefits from Air Transport in Nigeria, 2012

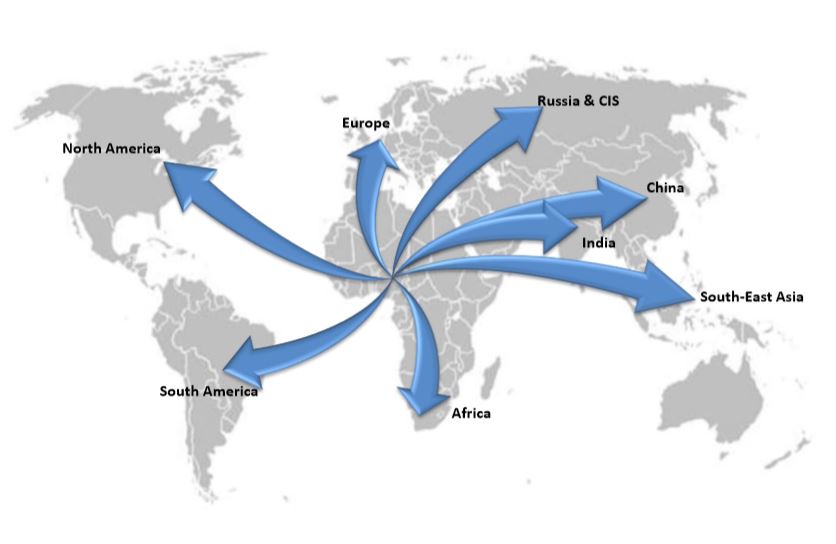

Nigeria’s location in the world

Nigeria is well situated in a central location in West Africa, with 923,766 square kilometres of land.

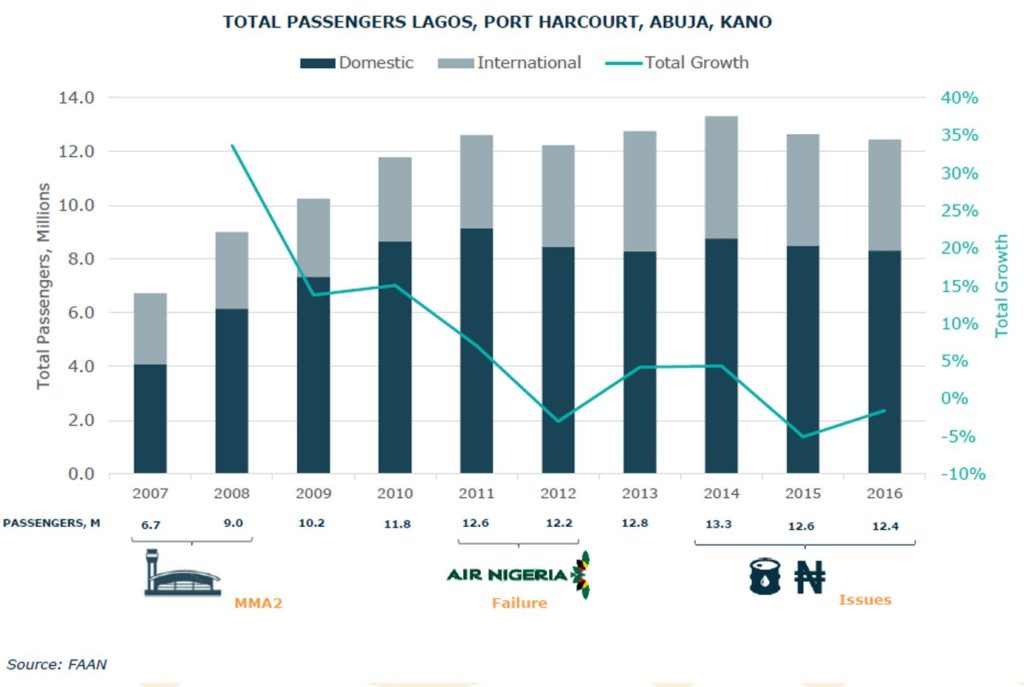

Most of the journeys occur between Lagos and Abuja the commercial and political hearts of Nigeria.

Population size

The current population of Nigeria is 202,811,829 as at 10 November 2019 (based on Worldometers elaboration of the latest United Nations data). Nigeria’s population is equivalent to 2.61% of the total world population.

With poor road infrastructure a national problem and security challenges which make road travel challenging and time consuming, movement by air will become increasingly sought after.

The Infrastructure Gap

There are currently five designated international Airports. One each in Abuja, Lagos, Kano, Port Harcourt, and Enugu (currently closed for refurbishment). There are 20-25 domestic airports around the various states in Nigeria (variances in government stats) , and a further 14 airports not owned or managed by Federal Airport Authority Nigeria (FAAN). The most recently developed airport is the Abuja international airport, with the Lagos international airport still as yet completed.

After years of failure to invest in transport of every variation (roads, railway, waters), and in aviation infrastructure in particular, the Federal Government (FG) of Nigeria is actively targeting the private sector to deliver the countries aviation needs.

Positive safety record

Nigeria has maintained a high level of safety with no accidents involving commercial aircraft recorded recently. The activities of the Accident Investigation Bureau (AIB), which was supported by the Safe Skies Africa Initiative, resulted in a record of three-year zero fatal accidents in commercial aviation. Still more progress can be made, but this is a positive for Nigeria.

Business aviation / Charter

Infrastructure challenges together with security concerns regarding road travel has pre-disposed many of Nigeria’s elites and some sectors of the business community to business aviation or charter. There was an estimated 150 private jet transactions in Nigeria in 2013. The Federal Inland Revenue Service stated there were over 200 private jet owners in 2017 evading tax obligations. According to the Nigerian Civil Aviation Authority (NCAA) 146 private jets fly into Nigeria frequently, 46 of these jets are registered in Nigeria. It is also estimared that N30 billion is spent every year on maintenance.

There are currently 21 Part 135-certified carriers specialising in passenger and business charter operations.

Government targeted opportunities

The FG and FAAN have identified opportunities in the following areas:

The Nigerian Aviation Industry has faced major challenges in the past. High fuel prices, lack of access to foreign currency, low aircraft utilisation, high maintenance costs, lack of investment in infrastructure, lack of access to capital. All of these issues have impacted the Nigerian aviation industry.

Size of the economy

Whilst Nigeria has the largest economy in Nigeria this needs to be looked at in the context of other countries and other states e.g. California state is economy generates $4tr vs Nigeria’s $400bn! What will work in a developed, more income rich location, will not work in Nigeria.

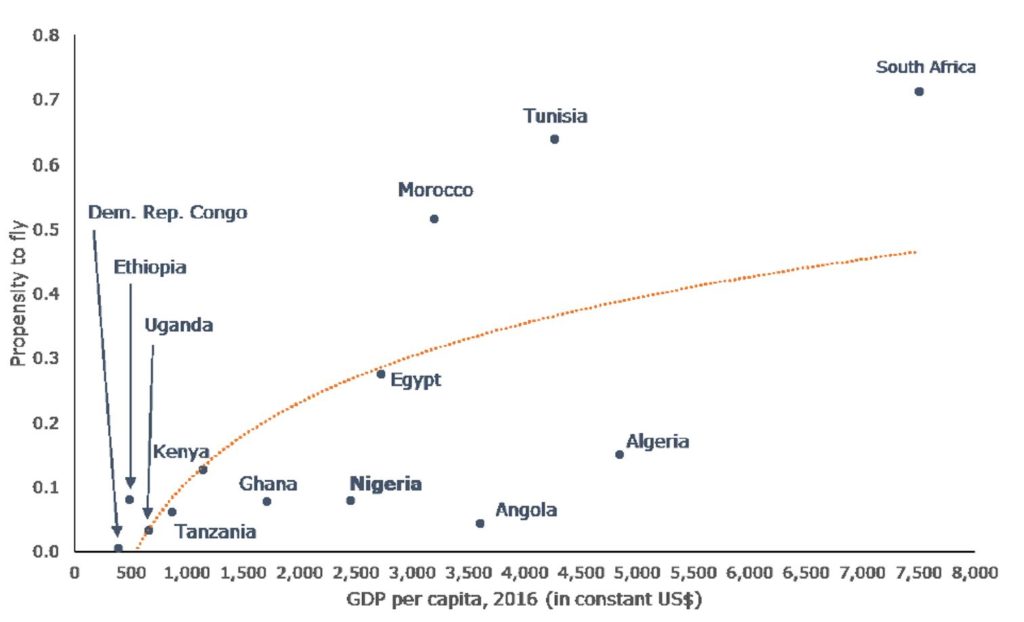

Income distribution / poverty

GDP per capita was reported as $2,049.11 in 2018, roughly N750K. However income distribtion is not even, with 98 million Nigerians deemed as living in multi-dimensional poverty.

Therefore looking at market size and the addressable market will help businesses targeting Nigeria create the right products for the market.

Low propensity to fly

Whilst the Nigerian market has huge potential based on population, previous experience and research has shown that Nigerians have a lower propensity to fly when compared to other African countries.

Declining aviation growth

15.2million passengers passed through Nigerian airports in 2018. However, despite the opportunities based on location and population size, air passenger traffic growth has been declining compared to the 2015 figures. There has been an increase in outbound flights (indicating more people leaving the country), but there was less inbound flights (which indicates the increased outbound flights were not for tourism purposes).

Decline of Nigerian airlines

Airlines have started and failed entirely, and lots more have failed partially or not lived up to expectations in Nigeria. There are always stories of a number of airlines which are about to launch, never to be heard of again.

In 2015 Nigerian airlines were operating international destinations, four years later in 2019, no Nigerian airline is operating internationally. Aircraft numbers have reduced from over 60 prior to 2015, to less than 35 (according to Airline Operators of Nigeria (AON). NCAA indicates there are 23 active domestic airlines.

The general downturn in the aviation sector is attributed to the economic crunch, recession of 2016 and the high capital outlay and harsh operational environment. . The aviation industry effectively became a casualty of the economic hardship experienced by several sectors in the economy.

Availabilitity of trained personnel

According to the NCAA there are 554-590 licensed pilots, 677 to 913 licensed aircraft maintenance engineers, and 19 flight engineers and 1103 to 1700 cabin personnel.

It is not clear from the NCAA website what the actual to date figures are.

Lack of supportive policies

Nigeria needs policies to support the growth of domestic airlines, for example code-share partnership policy to encourate collaboration.

High cost of aviation operations

A lot have been said about these problems by many others, so we won’t elaborate on these in detail in this article. Some of these items are also in the opportunities section, so solving these problems will be an opportunity for some companies.

Download FAAN Business Opportunities Brochure – FAAN Business Opportunities

Opportunities in the Nigerian Aviation Sector – FG Transport Tourism – April 2019

The mystery of market Size in Nigeria – Read article

Share: